I recently hosted a live chat to discuss “My Game Plan for the Year Ahead – Earn $1,200 a Month.” If you missed the recent live event, don't worry. You can click here to watch the recorded webinar in its entirety.

Who is the better options trader?

A. Two Nobel Prize winning economists who founded the very model that options pricing is based on.

Or…

B. A guy who thinks the market is like a giant poker game. Of course it's A … right? They are the geniuses, after all. I mean, they wrote the Black-Scholes options pricing model – the pricing model that every options trader uses directly or indirectly on a daily basis.

But if you've ever read the book When Genius Failed, you would quickly realize that the smartest people in the room are not necessarily the best investors or traders. In short, the two Nobel Prize winning economists – Myron Scholes and Robert Merton – lost $4.7 billion in four months of trading. That's billion. With a “B.”

And while they were losing money, the trader who views the market as one big poker game was making billions – also with a “B.”

And he was doing it using probabilities. As I always say, it's all about the probabilities. (Click here to find out how Mr. Yass continues to outperform the smartest people on Wall Street)

His name is Jeff Yass and he runs the most successful options trading firm in the world, Susquehanna Investment Group.

I mention poker because Mr. Yass thinks in terms of probabilities. And that’s exactly what options and poker have in common – thinking in terms of probabilities.

Every options and poker professional will tell you the same thing – the longer you play with a negative edge, the greater the probability of eventual financial ruin. Probably the most basic requirement for successful trading is that you must have some well-defined method – a specific approach – that gives you an edge.

That approach could be buying undervalued securities and selling overvalued securities, or it could be some better-than-breakeven way of selecting price-directional trades.

Without such a method or edge, you will eventually lose, because the odds are 50/50 before transaction costs.

By the way, if you don't know what your method is … you don't have one.

Which is why I trade credit spreads. It gives me a defined edge. The risk is defined on each and every trade. And it allows me to choose my own probability of success.

Why do credit spreads give me an edge?

Let me explain in poker terms.

Professional poker players are known to seek out "soft" or "weak" tables as a source of income. This means that the more inexperienced players there are at the table, the easier it will be for the seasoned pro to take their money.

It's really no different in the world of options, particularly when using trading strategies with a statistical edge like credit spreads.

Finding the consistent loser or novice trader is how the option pros generate the bulk of their gains. When I trade credit spreads, I take advantage of the speculation of others, typically newbies who are buying out-of-the-money calls or puts with the hope that they will eventually move into the money.

But there is, however, a skill in knowing who those amateurs are and what behaviors they exhibit to clue you in on their lack of experience.

In poker, the individual who shows too much emotion or doesn't truly understand the game will be cleaned out in short order.

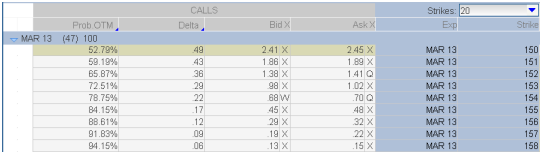

In options trading, everything is laid out in the options chain – a list of option characteristics at different strike prices. By looking at the "probability of expiring" – the chance that a stock or ETF will close above (for calls) or below (for puts) the chosen strike price – the options trader can make decisions based on the speculation of others. But unlike poker, the participants show their hands when trading credit spreads.

This is THE advantage credit spreads offer over any game or investment vehicle out there.

For instance, with SPDR S&P 500 (NYSE: SPY) trading around $150, some traders are making wagers that SPY will move above $155 by March options expiration (March 15). The chance of the happening is 15.85%, as shown in the first column below (1 – probability of closing out of the money).

What about traders who think SPY will push above $157 by March options expiration? The chance of that happening is 8.17% (1 – 0.9183).

With those types of odds, why wouldn't I want to take the other side of the trade? Depending on which credit spread I choose, my probability of success is 80%-90%.

And this is the reason why Jeff Yass is a billionaire with one of the most successful options trading firms in the business. He understands probabilities. The so-called geniuses might have the formula, but without a strategy with an edge you are just another trader playing a zero-sum game. Unfortunately, that is why so many fail at trading options and stocks. They don't understand the true statistical edges provided them by the market.

You can learn more about how I safely use options for both income and to steadily grow my investment account by clicking here.

Kindest,

Andy Crowder

Editor and Chief Options Strategist

Facebook

Facebook

Twitter

Twitter