Now may be a golden opportunity to buy Apple (Nasdaq: AAPL) at a huge discount. The price of Apple stock is now 10% below the first-quarter earnings pop. The cheap stock also carries a measly forward P/E of 10, which is well below its normal level.

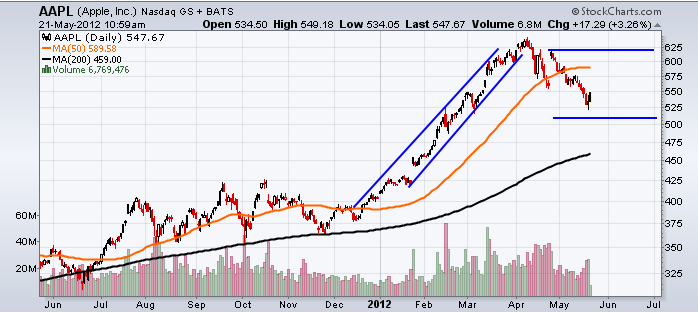

A short-term Apple chart was covered in an April video. In that video, I mentioned how important it was to the bulls for the shares to hold at $600. I also mentioned that should $600 break and not provide support, the stock was heading to $520, which would correspond to a large market pullback.

After a little less than a month later, our worst-case scenario unfolded, the price of Apple stock tagged $522.18 on May 18. Additionally, the Nasdaq fell from 3,085 to 2,774.79 in May

The failure to hold $600 a few weeks ago likely means that Apple ended its bullish phase that took the stock from $363 to $644 in six months. However, I suspect AAPL will hold $500 over the next three months and eventually rally well above $700 and to new highs in 2012.

I expect shares to trade between $619 and $510 over the next two months. New buyers can take a position below $545. It would be a significantly bullish move were Apple to take back $619, too.

Facebook

Facebook

Twitter

Twitter