Maybe the Federal Reserve should just send each of us a check for $1 million.

Why not? Then we would all be millionaires. We'd all be prosperous. No one would have to work.

I hope you appreciate the absurdity of my suggestion. After all, if more money were the key to prosperity, Weimar Republic Germany and Zimbabwe would rule the world

Prosperity isn't predicated on printing deceased politicians on little pieces of paper; it's predicated on work that creates value for others. Printing more money simply debases the value-creation process.

It also debases the purchasing power of everyone holding the debased money.

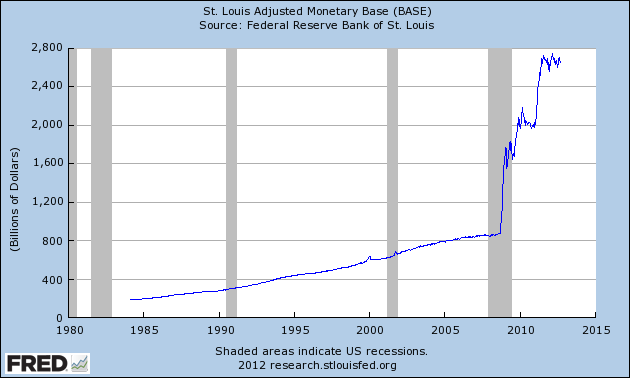

The Federal Reserve has been debasing money at an unprecedented rate since 2009. Last week's announcement that it would continue to debase money – promising to buy $40 billion of mortgage-backed securities (MBS) monthly until America's financial outlook improves – assures the trend will continue uninterrupted for Lord knows how long.

The Fed's MBS purchases will be paid for with new money, as if a money shortage were the problem. Seems to me it isn't. In fact, the Fed's own data show the base money supply has more than tripled in the past three years.

This money-pumping is a terrible trend, and it's one many investors refused to be duped by.

The share price of the SPDR Gold Trust ETF (NYSE: GLD) spiked immediately higher after the Fed's latest money-creation announcement, as did many hard-commodity producers I follow: Southern Copper Corp. (NASDAQ: SCCO), Titanium Metals (NYSE: TIE), Rio Tinto (NYSE: RIO), and High Yield Wealth portfolio investment Plum Creek Timber (NYSE: PCL).

The trend in money creation and the trend in gold and commodity prices and the share price of commodity producers tells me investors are looking for stores of value.

Hard commodities and gold are stores of value and will remain the preferred hedge against money inflation.

Because the Fed is committed to expanding the money supply, I see little incentive for the trend in gold and hard commodities prices to reverse course. Even if supply and demand dynamics remain constant, gold and hard commodity prices should continue to rise. Most commodities, after all, are priced in U.S. dollars on international markets.

Needless to say, I like gold and I like the companies I mention above, particularly Plum Creek Timber.

Timber is a terrific asset that most investors overlook. Timber has proven to be an excellent inflation hedge, which is what you need to maintain portfolio value. What's more, it's lowly correlated with other asset classes, which helps reduce portfolio volatility.

In short, adding a timber investment to your portfolio enhances its return potential while simultaneously reducing risk. Therefore, I'm not surprised timber has been a strong performer in this monetary-inflation environment: Plum Creek Timber has returned 20% since being added to the High Yield Wealth portfolio in January.

There’s no sense in fighting the Fed's money-debasement trend. So I have little interest in fixed-income debt, bank certificates of deposits, and other investments that fail to maintain purchasing power and are at risk of price depreciation.

The issue I have, from an income investor's perspective, is maintaining current purchasing power through cash flow produced by my investments. Sure, I want the price appreciation that gold and commodities will likely produce over the next couple of years. I want a store of value, but I also want regular cash flow that exceeds the monetary inflation rate.

Most commodities and gold investments typically aren't high cash-flow investments.

But I've found one that is.

In an upcoming issue of High Yield Wealth, I'm planning to feature an investment that invests in gold, commodities, and natural resources. This investment not only offers the inflation production of these asset classes, it also offers a high regular cash distribution to investors.

If you are concerned about maintaining your wealth and purchasing power, this investment is certainly worth a close look.

Facebook

Facebook

Twitter

Twitter