If you've invested in ETFs over the past few years, you've probably lost money on at least a few of them.

And I can understand why. There are so many investable ETF choices out there that it's easy to be tempted into evaluating all of the exotic offerings, many of which have no business in a Main Street investor's portfolio.

But that doesn't mean there are no good ETFs. In fact, there are three commodity ETFs that I think are great buys right now (more on that in a minute). That's because it's hard to argue with the practicality and simplicity of these good ETFs.

Now, I'm much more of a stock picker, so don't get me wrong here. I'm not turning away from my roots. But in certain situations and to achieve certain investment goals, ETFs just make sense.

There are now more than 1,400 ETFs to choose from, covering pretty much any asset class an investor could ask for. And many online brokers allow you to trade ETFs commission free.

TD Ameritrade has the best deal going, with over 100 ETFs from iShares, Vanguard and others available to trade with zero commission. Fidelity offers 30 commission-free funds from iShares.

But in typical Wall Street fashion, the number of ETF products out there has gotten a little out of control as the industry competes for assets. So you really need to read the fine print before placing a buy order.

One upside of so many ETF choices is that competition often breeds competence. And that cycle is responsible for bringing us lower (or no) commissions, lower management fees and, in some cases, better products.

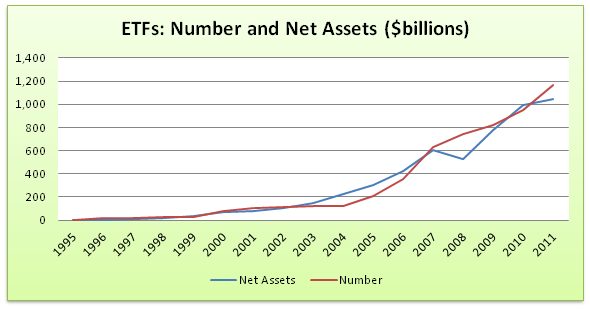

As a result, investors are piling into ETFs. In 2000 there were 80 ETFs with total assets of $66 billion, according to data from The Investment Company Institute.

The offerings have grown fairly steadily over the last 11 years to the point where there are now closer to 1,450 ETFs with total assets of more than $1 trillion, as this chart shows (data is through 2011).

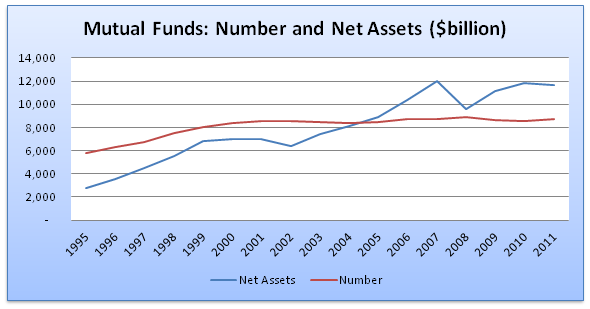

The surge in ETF popularity has to some extent come at the expense of the industry's primary competition – mutual funds, though ETFs have a long way to go before the playing field is even. In 2000 there were more than 100-times as many mutual funds (8,370) as ETFs, and mutual funds had more than 100-times the assets under management (nearly $7 trillion).

The chart below shows that while the mutual fund industry is far larger – now it has closer to $11.7 trillion under management and 8,700 funds – growth has been far slower than in the ETF industry.

The obvious benefits of an ETF are the sameas those of a mutual fund – exposure and diversification to a certain investment theme in one package. But ETFs have many more benefits, often including lower management fees and intra-day trading.

They've become a favorite especially for commodity investors, who previously needed to deal with far more complex markets to gain the desired exposure. As a result commodities and natural resource-related products has been one of the fastest growing areas for ETFs in recent years.

Surging gold and silver prices have certainly helped fuel this growth.

Now, with so many ETFs tracking commodities (both spot prices and derivatives), resource-related equities, currencies and all the other options, simplicity is still the best recipe – even though it can be hard to achieve.

There is a lot of information to wade through for what should seemingly be a simple investment class to analyze. That's why I've focused on ETFs in this month's issue of Pay Dirt, where I outline the details on the only three ETFs commodity investors need to own.

Good Investing,

Tyler Laundon, MBA

Editor, Pay Dirt

Facebook

Facebook

Twitter

Twitter