Do you think about probabilities on each and every investment/trade you make? You should.

A football analyst can tell you the probability that a team scores after entering the red zone.

Baseball analysts will tell you with certainty the percentage of times that a catcher throws someone out at second base.

Why? Because these probabilities matter and they are easy to figure out. They simply look at the data that is presented to them.

So, why is it that when I read a research report from a financial analyst they can’t just simply tell me the likelihood that a stock will meet their expected price targets?

Instead, the actual "pros" in the stock picking business give you a buy target – no probability that the target will actually get hit. That’s amazing to me…

The analysis coming out of Wall Street’s best has nothing to do with the actual likelihood of success! Wall Street analysts are little better than Vegas bookies.

I’m simply not interested in analyst estimates. And if you want to make money in the markets, I think you’d be best advised to ignore them. That’s because a price-target is just a guess in my opinion. And I’m not interested in guesses.

I want to hear the that the statistical chance of the stock going to $19.00 is X%, the chance of the stock going to $19.00 in three months is Y% or a stock moving lower over the course of the next year is Z%.

Confused? Let me explain, because after I do you will never look at an analyst’s price target the same.

Probability of a Stock Touching a Specific Price

Apple (Nasdaq: AAPL) is currently trading at $385.68.

And yet, forty-seven of the most, well-respected Wall Street analysts have a median target of $500 for the stock, with a high target of $700.

So, how realistic are the professional analysts’ price targets? Let me show you what the actual market expects.

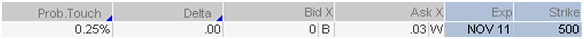

As you can see below, the probability of touching AAPL $500 in the next 8 days is 0.25%.

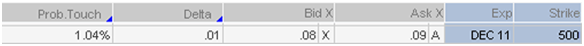

In the next 36 days the probability of AAPL touching $500 is 1.04%.

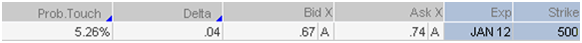

In the next 71 days the probability of AAPL touching $500 is 5.34%.

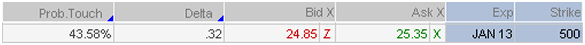

In the next 435 days the probability of AAPL touching $500 is 43.65%

As for AAPL touching the high target of $700 – well, the market doesn’t even register a probability right now.

How do I get these probabilities? It’s easy. I take the delta of a certain strike price and cut it in half. Most savvy options brokers offer accurate "probability of touching" data as part of their software package.

So as you can see the probability of Apple successfully reaching $500 over the course of the next year or so is not very high, yet most of the professional Wall Street analysts are predicting such a move with little regard for the statistics.

Why would you ever buy a stock based on an analyst’s price target that has a chance of success of only 1%, 5% or even 43% of the time. It’s pure insanity. Yet, this is how the majority of investors invest their money – blindly listening to Wall Street predictions that do not make any sense.

There is a reason why I focus on probabilities of success so much – because it is truly what investing is about. It is the edge that gives self-directed investors the ability to become far better investors then there professional counterparts.

The advantages of using probabilities of success are critical to how I manage the $25,000 live account here at Wyatt Investment Research through my options service, Options Advantage.

One day I would love to hear an analyst on CNBC actually state that the reason they are predicting a stock to move to a certain price is because it has a probability of success that is actually greater than 50%.

How do I make my trades based on probabilities? Well, my starting point is 67%. That’s a fair margin of error in my experience.

I only consider a trade if it gives me a real statistical advantage. You should too. The same basic strategies are used every day by the likes of John Madden and other sports analysts. They work for investing just as well.

Andy Crowder

Editor

Options Advantage

Facebook

Facebook

Twitter

Twitter