Today I’m cooped up in an Alexandria, Virginia hotel room while my

wife attends a

National Association of Drug Court Professionals

conference.

If you’re not familiar with drug courts, and how they can save our

criminal justice system huge amounts of money every year, you should read

this brief article in the Economist

about how drug courts keep drug addicted Veterans out of prison – by keeping

them clean and sober.

I won’t ruin the ending, but basically these courts seek to help

people beat their addictions instead of throwing them in jail where they’re

not likely to get much of any treatment – and their rate of drug abuse is

likely to increase. A novel approach…

Anyway, while I’m in the air conditioning, I’m answering reader

questions about how to meet commodity investment goals.

Reader Tim V. wrote in to ask:

”Kevin,

I’m 50 years old. I recently dumped my 401K investment company (which didn’t

do much of anything unless I called), and put the money in an account I

control. So, $300K to manage and not much time for the "investment noise"

you mentioned in one of your articles. Working each day doesn’t leave me

much time to investigate all the investment opportunities of the day. What’s

your suggestion for the top 3 things to invest in and not have to look at it

for 10 years?

Thanks,

Tim V.”

Tim, thanks for writing in with a really tough question. I don’t know if I

have the exact answer you’re looking for, but I won’t shy away from this

fastball.

I think Tim has probably done himself a service by getting out of his 401(K)

now instead of waiting for it to tumble again. The problem with most of the

investments you can buy with 401(k)s is that they’re almost always heavily

dependent on the performance of the Dow. So you’re letting 30 of the largest

companies traded in the New York Stock Exchange dictate the success or

failure of your retirement account.

That doesn’t sound like diversification to me – which is supposed to be the

whole point of a modern portfolio approach to investing.

Anyone with access to a chart of the Dow over almost any period can tell you

that there are times when you should buy the Dow – and times when you

shouldn’t.

Before I get into my top 3 recommendations for Tim, I’d like to point you in

the direction of a simple tool that can tell you when to buy, hold and sell

the Dow.

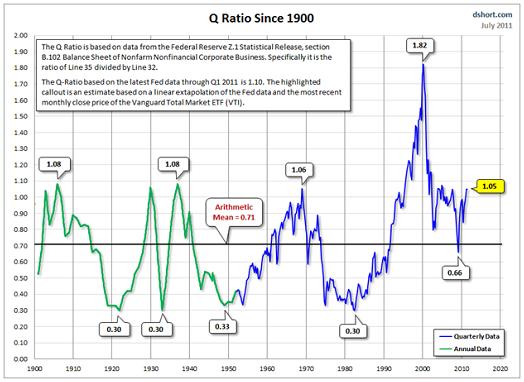

It’s called the Q-ratio, and it takes a very macro look at how relatively

expensive the Dow is at any given time.

Basically, it divides the Dow index by the cost of replacing each business

in the Dow entirely. It sounds kind of arbitrary, but it gives you a very

specific look at how much you’re paying for the Dow at any given time. After

all, if the price tag on a business is significantly more than the cost to

build that business from scratch, then you probably wouldn’t buy that

business.

Likewise, if the price tag on, say, ExxonMobil (NYSE: XOM) was 50% LESS than

the cost to build Exxon from scratch, you’d probably jump at the chance to

buy it.

That’s a simplified explanation of what the Q-Ratio does. Here’s a

relatively updated (July 1, 2011) chart of the Q-Ratio:

You can also

click here to read a more in-depth piece on the Q-Ratio.

Moving onto Tim’s question…

As you can see from the chart above, Tim probably got out of his Dow-heavy

401(k) at a good time. Over the past 100+ years, the Dow fell precipitously

after hitting this approximate level.

So the question is, what

are the 3 things Tim should buy today to hold for the next ten years.

And it’s a tough question

right now because our Federal Government’s massive stimulus plans have flooded

nearly every asset class and made everything expensive.

Looking at stocks, real

estate, bonds – even commodities – almost everything appears expensive.

But there are a few assets

that I’d like to own for at least the next few years – if not the next ten

years. I’ll leave the portfolio allocation up to you.

1. Gold (and silver). You’ve

heard me go on and on about gold. I own gold not as a speculation that inflation

will rise, or as a way to trade in and out of currencies. I view my physical

gold as liquid cash savings that can’t be inflated away. So whatever liquid cash

savings you deem necessary to hold near and dear – I’d move it into gold and

silver. I buy my gold and silver from

kitco.com and

blanchardonline.com.

2. Energy. As expensive as

oil is you know it’s only going to get more expensive. And right now, you can

still buy natural gas investments for relatively cheap. My friend and colleague

Tyler Laundon recently completed an excellent natural gas research report.

Click here to take a look.

But it’s not just natural

gas. Coal will be a great place to be for at least the next ten years. And

though you probably don’t want to hear it, uranium is probably a steal right

now. It could go lower, but not much.

Energy is a great place to

be because you know the world is going to keep using it. Even during another

recession or depression. People will cut every expense out of their lives

besides food, water and shelter before they cut energy. And there’s huge growth

in this sector in the developing world.

3. Agriculture. This one is

tricky because it seems so expensive right now. I think it will be a strong

trend over the next decade, but you need to pick your spots. Farmland prices are

off the charts. Softs (wheat, corn, soybeans, etc.) are pricey.

With all three of these

trends, I’d also look for ways to collect income and to then reinvest it.

Whether it’s in the form of dividends, or an options strategy, if you really

want to build your wealth over the next ten years, you need it to compound

itself.

Our Chief Options Strategist

here at Wyatt Investment Research, Andy Crowder, has been successfully trading

income-based options strategies for well-over a decade and enjoys helping others

learn his disciplined approach to trading options for income. Please do not

hesitate to email him at

[email protected] if you have any options-related questions,

particularly if they involve income-based options strategies.

Facebook

Facebook

Twitter

Twitter