- How to

buy gas for 48 cents per gallon – no joke - Why to

buy now - What

to buy now

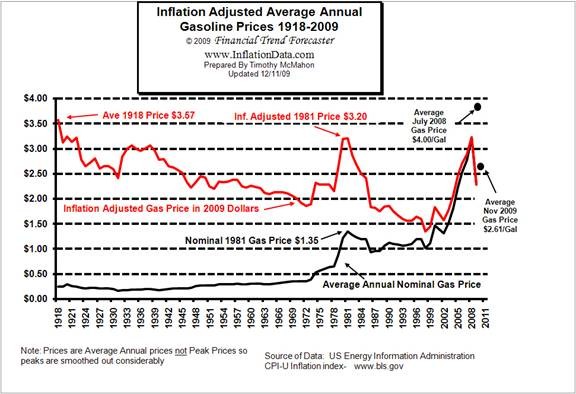

You probably remember when gasoline cost 48 cents a

gallon. It was in 1974 – not so long

ago, really.

Inflation adjusted for 2009 dollars, gas was never that

cheap though. It bottomed in 1999 at

about $1.40.

So I realize it sounds too good to be true to suggest that

you can buy gas for 48 cents today. With

most of us paying close to $3/gallon it’s just a ridiculous claim.

And of course, there is a catch. Consider it a small April Fools day

hoax. I’m not talking about gasoline…I’m

talking about natural gas. You might be

cursing my misdirection – but that’s exactly why I’m excited about this ultra-cheap

resource: Most people don’t care about natural gas; they take it for

granted. It’s super plentiful in the U.S.

and it seems like every day there’s another massive natural gas discovery. President Obama just proposed a plan to allow

drilling along the Atlantic coast, the north coast of Alaska

and the eastern Gulf of Mexico yesterday that will

likely unearth even more natural gas.

We have so much that we literally don’t know what to do with

it. Long term, we’ll put it to use,

whether it’s to power automobiles, electricity generation, to heat more of our

homes, or to be used in industry.

But right now, it’s just sitting around. Natural gas producers have started to “store

it in-ground” – meaning they’re just sitting on it, waiting for the price to

rise.

It’s cheap. The

natural gas energy equivalent of one gallon of gasoline costs just 48

cents.

According to a Financial Times article in March of this year

we have “enough [natural] gas to last… for a century.”

Oil tycoon T. Boone Pickens says that if we can’t figure out

how to capitalize on this massive energy resource, then we’re “the dumbest

people in the world…”

Well, I don’t think we’re the dumbest people in the world –

it just might take gasoline at $5 a gallon to spur us in the right direction. But right now you and I can capitalize on

this opportunity by buying stock in natural gas companies.

The biggest blockade to adopting natural gas for automobiles

is the same as for every other alternative energy source: infrastructure. There are very few natural gas filling

stations in the United

States. There are only a handful of manufacturers making vehicles that run on

natural gas. So, today there’s just no

economy of scale for the resource.

But it’s a potential tipping-point situation. The diversion between natural gas and

gasoline will eventually make natural gas the only economic choice for manufacturers

of new vehicles.

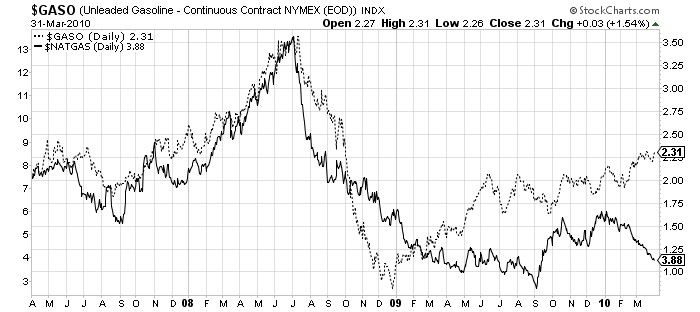

The chart plots the price of one gallon of gasoline as the

dotted line, and the price of 1,000 cubic feet of natural gas as the solid

line.

Demand for natural gas vehicles will skyrocket as gasoline

gets more expensive. Remember all of the

hubbub about the Toyota

(NYSE: TM) Prius when gas prices spiked in the summer of 2008? They couldn’t sell them fast enough.

So buying stock natural gas companies is a long-term

play. But even in the shorter-term,

natural gas prices should rise. Could it

go lower? Sure. But not much lower. I’m not timing the market – I’m buying

because natural gas is cheap.

And today, you can buy natural gas companies for extremely cheap. I’m talking cheaper than you’ll likely ever

see them again.

At today’s prices, you’re locking in the upside of the

inevitability that the U.S.

and eventually the whole world will have to find another fuel source for personal

and commercial vehicles.

Some of my favorite natural gas companies are royalty

trusts. These companies pay no corporate

tax as long as they pay out at least 90% of their profits in the form of

dividends.

And since natural gas is so cheap and these companies don’t

get any of the same love and attention from the mainstream media as oil

companies, their dividend yields are massive.

One company I’m looking at right now is Hugoton Royalty

Trust (NYSE: HGT).

It pays a 10.4% dividend.

The best part? This

company has almost zero exposure to fixed costs in the industry – which can be substantial. That’s because they just collect royalties on

the sale of natural gas through XTO Energy (NYSE: XTO).

These royalty companies do two things: they loan money to

companies in the exploration and pre-production stages – then get paid a floating

royalty rate on any profits for the lifetime of the other company.

There’s only two downsides for this type of company.

1) If natural gas prices go lower Hugoton would receive smaller

royalties from XTO. Natural gas prices

are already rock bottom, so this scenario isn’t likely.

2) If XTO runs out of natural gas to sell, they cease paying

royalties to HGT. But that’s not a

likelihood. XTO has proven natural gas

reserves of over 12.50 trillion cubic feet – that’s the equivalent of 100

billion gallons of gasoline – or nearly enough to supply every single vehicle

in the United States

for a whole year.

So they’re not running out of natural gas any time

soon. A $10,000 stake in Hugoton would

pay you $1,040 in royalties every year, which can help take the sting out of

higher gas prices in the meantime. This

company is a great income investment in the sector – but there’s a better way

to play the trend of rising natural gas prices.

Chief Analyst Ian Wyatt recently selected another natural

gas company for Energy World Profits, his advisory service all about energy

investments.

It’s even bigger than XTO with over 14 trillion cubic feet

of natural gas. Low natural gas prices

have pushed this company well below the buy-up to price and today this company

is almost as cheap as it’s been in the past 6 months.

There’s no better safe-play in the natural gas sector. This company is the best-of-class for the

field, and buying it today would be like buying Standard Oil with John D.

Rockefeller. As the world slowly weans

itself off gasoline, natural gas will be the only alternative standing.

Click here to get the full details Energy World Profits –

and Ian’s favorite natural gas stock right now – including a way to get a free tank of gasoline.

Good investing,

Kevin McElroy

Editor,

Resource Prospector

Facebook

Facebook

Twitter

Twitter