It’s tough to say exactly how long it’s going to take to get a resolution of the

Greek debt/bailout situation. Every time it seems like progress is being made,

the process takes a step backwards.

For an interesting perspective on the Greek situation, and what a debt default

might mean, I’d like to introduce you to one of the newest members of my team,

Rick Pendergraft.

Rick is a 20-year investment veteran, and runs his own money management firm.

Rick is also running the brand new

ETF Master Portfolio advisory service here at Wyatt Investment Research. For ETF Master Portfolio , Rick uses the very same ETF investment strategies

that are making his money management clients successful.

As a 20-year veteran, Rick has successfully navigated some of the biggest

economic booms and busts. And he’s got some very interesting ideas about the

Greek debt situation, and how you can navigate this period in investment

history.

So, here’s ETF Master Portfolio’s Rick Pendergraft:

Greece 2011 Versus Russia 1998

Over the last few months the financial news has been dominated by news out of

the Eurozone and in particular about the national debt of Greece. Will they

default? Will they get another bailout package? What will the impact be on the

global financial system?

All of this talk led me to look back at the summer of 1998 and the Russian debt

default that derailed the global financial system and led to the collapse of

Long Term Capital Management (one of the largest hedge fund firms in the world

at the time).

My thoughts lead me to a comparison between the two countries and the potential

impact. In 1998, Russia’s Debt to GDP ratio was 57 percent. Their GDP was $220

Billion which means the national debt was approximately $131 Billion. The total

world debt of sovereign nations in 1998 was just over $27 Trillion making

Russia’s share of the world debt approximately 0.47 percent.

Jump ahead 13 years and the picture of Greece isn’t that different. Greece’s GDP

is $330 Billion and the debt to GDP ratio is at 144 percent. This means that

Greece’s total debt is in the neighborhood of $475 Billion. The world’s total

sovereign debt has tripled since 1998 with the total standing at $82 Trillion in

2010. This means that Greece’s debt as a percentage of the total sovereign debt

in the world is 0.57 percent.

When Russia went into default, it seemed to catch the financial markets off

guard at the time. The news about Greece’s issues has been in the headlines for

over a year now. Anyone still holding Greek debt that is caught off guard by a

default has taken the ostrich approach and buried their head in the sand. Anyone

that bought Greek debt in the past year took a gamble, hoping to take

advantage of the extremely high interest rates and counting on a bailout.

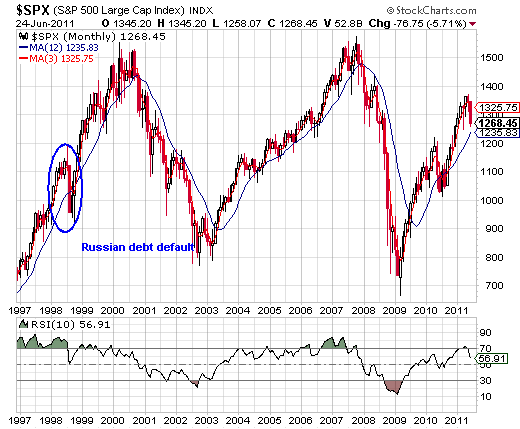

Keeping with the comparison, I decided to take a look at the chart of the S&P

500 back in 1998. What we see is that the Russian debt default had a sharp but

brief impact on the U.S. stock market. The S&P dropped over 14 percent in August

of 1998.

I circled the drop from August 1998, but I want you to look at what happened

leading up to the default and what happened in the ensuing months. Essentially,

the news of Russia defaulting on its debt erased the previous seven month’s

worth of gains. It also took the S&P just over two and a half months to erase

the decline.

If we look at today’s market, to erase the previous month’s gains, the S&P would

need to drop down below the 1,200 level. The loss was 14 percent back in 1998.

For the S&P to decline 14 percent from the high in May, the S&P would need to

drop to 1,178 or another seven percent.

The point is, even if Greece defaults on its debt, it should not mean the end of

the world. In fact, it could lead to a tremendous buying opportunity. We might

not have hit bottom just yet, but the levels of sentiment and the move from

overbought levels to oversold levels have certainly made equities more

attractive.

So How Do You Play It?

Looking at the weekly chart of the S&P, we are at the midpoint line of the trend

channel. We could see a technical bounce from the oversold levels and from the

support, or we could dip down to the lower rail of the channel over the coming

weeks.

What I have been doing for my investment management clients is moving half of

their cash into ETFs that I feel are the best opportunities right now and

leaving half in cash. If we dip down to that lower rail I will add to the

positions. The extreme oversold levels and extreme pessimism from the sentiment

indicators suggest a bounce is near. But rather than dive in head-first with

everything, I prefer to wait and make sure the support holds.

Rick Pendergraft

Editor, text-decoration: underline; text-underline: single">

ETF Master Portfolio

I hope you’ve enjoyed Rick’s thoughts and analysis on the Greek debt situation.

If you’re interested in learning more about the ETF investment strategies Rick

uses, you can check out ETF Master Portfolio HERE.

Facebook

Facebook

Twitter

Twitter