Amazon.com (NASDAQ: AMZN) reported earnings that beat The Street in April, causing the shares to rise 15% to $226.85 overnight. The stock then moved higher to top $230 before a broad market retreat brought it back to $214.

Despite the pullback over the last few weeks, AMZN shareholders should think positively. The shares are coming up on two levels of support that should end the decline that began at $233.84

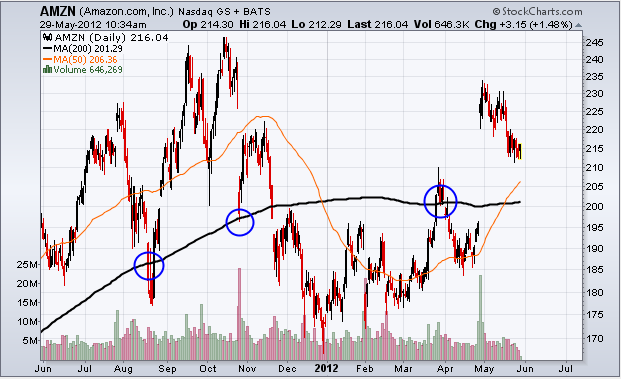

The first level of support is the rising 50-day moving average (orange line in the chart below), which has frequently been a zone where Amazon.com stock will reverse its short-term course.

The second level of support is stronger. The 200-day moving average (black line) was a major reversal region three times in the past year.

Traders can begin to position for a reversal at these two price points over the next month. I expect the shares to quickly bounce back to $231 once a reversal has been established at either the 50-day or 200-day moving averages.

Equities mentioned in this article: AMZN

Facebook

Facebook

Twitter

Twitter