My favorite thing about trading options is the fact that I know my risk-reward and my “probability of success” BEFORE I make each trade.

I typically find trades that will give me a 75-85% chance of success – and if I'm even a little careful and diligent about picking my spots, I can increase that likelihood to over 85%.

Now, you might be thinking that it's impossible to calculate the probability of success. And that might be true if you're buying a regular investment.

But with options, there's an easy and quite accurate data point that tells me exactly what my odds are for each trade.

It's called "delta."

The first "Greek" that most options traders learn about when they get started with options is delta. Most people learn that delta tells us how much the price of an option will change if the underlying stock or ETF changes by $1.00.

For example, if you own a call option with a delta of 50 every $1.00 increase in the stock or ETF equates to a $0.50 increase in the price of the option.

But, when trading credit spreads the most useful way to think about delta is the probability of success for your trade.

Let me explain.

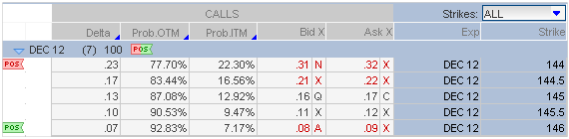

As you can see below, the trading software that I use (ThinkorSwim platform) tells me the probability of success or probability of the strike closing in-the-money. In this case the short strike of Dec12 144 (indicated by the small red POS banner at the left side) only has an 22.30% chance to close in-the-money or above the Dec12 144 strike. Notice the delta of the Dec12 130 strike is 0.23, basically the same as the probability of expiring in-the-money.

So with one week left until December expiration we have a 77.70% chance of success. Remember, we make money with a credit spread when the options contracts expire worthless. Keeping close tabs on the Prob.OTM, Prob. ITM or delta is a great way to monitor your credit spread position and one of the best ways to choose a trade that fits your risk profile. I've talked before about the importance of position sizing. Using delta to calculate your success probability will help you make intelligent choices about your position sizes.

For instance, even with a 77.7% success probability, you wouldn't ever want to risk all of your funds, or even half or a quarter of your funds.

That 22.3% probability that you'll lose money should make you acutely aware of how much you're risking, and how much you could lose should the trade go against you.

Keeping position sizing in mind along with probability of success will keep you in the game for the long haul – and that's the only way you're going to have sustainable success as an options trader. Remember, trade small and use the probabilities to your advantage.

Facebook

Facebook

Twitter

Twitter