-

Why technical analysis is dust in the

wind - Why Bernanke trumps TA

-

Benefit from the dips with this gold

stock

It’s always an education to look at the other side of the

argument.

In a July

10th article on Seeking Alpha, I found what can only be called

a complicated chart which is supposed to illuminate the technical reasons why

silver is due for a fall in the near-term.

Here’s the chart, for the masochists in my

readership:

Even after reading (and re-reading) the accompanied

explanatory paragraph for this chart, I still have no idea what I’m supposed

to be seeing. Will silver prices break down for technical reasons? The author

seems pretty certain. But I’m hesitant to rely on technical indicators as a

reason to modify my precious metals investment thesis.

My advice: forget

technicals for precious metals, because technicals are always right until

they’re astoundingly wrong – and they’re brainless when it comes to big

events – which can render irrelevant even the strongest candle-technique,

monkey-style, volume-judo that Techie T Techerson can unearth.

Chartists focus on patterns in the tea leaves, and

admittedly, they can do some

those tea leaves in the short term. I’ve seen our own Jason Cimpl make

regular, solid gains in one week to one month holding periods with stocks.

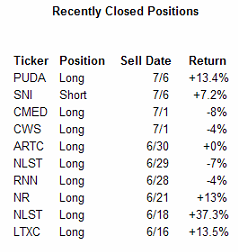

(to the right you can see a list of Jason’s recently closed positions from

his paid service Trademaster Daily Stock

Alerts)

But for precious metal investors who are in it for the long

term, it doesn’t make much sense to pay attention to tea leaves when any gust

of wind (big event) can blow those tea leaves clear out of the cup.

What’s the big event that will derail any technical

chartist’s master-level thesis on silver?

It’s sewn into Ben

Bernanke’s underpants: “Thou Shall not Allow Deflation.”

The Federal Reserve and our Federal Government itself are

kabuki players in a Keynesian drama. Standard bearer and Nobel-Laureate

economist Paul Krugman is

still urging lawmakers to spend yet more – because, as he says, the

only problem with the economy right now is that the Feds aren’t spending

enough! At this point, the Fed, the Congress and the President have entered

into a Keynesian suicide pact and Krugman is loading the gun.

Do you think they’ll all of a sudden switch horses and

pursue fiscal and monetary austerity – or do you think they’ll print

$trillions more in order to “solve all our problems”?

If the technicals on silver (or gold, oil, natural gas,

coal, sugar, wheat, rice, etc. etc.) breakdown and give us another chance to

load up on all of them at a discount to today’s prices… that’s good news –

but it doesn’t change the fact that our Fed Chairman says that he will avoid

deflation at every cost, and that silver and gold (et al) are due for much

higher dollar denominations.

I’ve been recommending that you buy these commodities on any

price weakness, with the understanding that these dips are times to gobble up

more of the pie – and to further hedge yourself AWAY from holding cash, which

is now a political tool just as much as a currency, and INTO real assets and

the appropriate securities.

To back up for one second, I should note that even the

temporarily bearish author of the aforementioned seeking alpha article ends

it with this sentence:

“Please note that this is

not the end of the bull market for silver.”

Okay. So it would seem that my recommendation would be to

continue to look for weakness in commodity prices as an opportunity to buy

more.

If I sound like a broken-record it’s because the situation

for the dollar is only getting worse. The only people minding the store are

steadfastly in the “dollar devaluation” camp – so there’s little alternative

but to protect your wealth with precious metals.

My favorite way to profit from rising gold prices is a

small-cap gold producer, hauling thousands of ounces of gold out of the

ground in North America. They’re one of the lowest-cost producers in the

market, and every increase in gold’s price hits their bottom line. You can

still buy this company for around $4 a share, but I expect that number to

double in the next year or so if not sooner.

Click here

for the full write-up on this company.

Good investing,

Kevin McElroy

Editor

Resource Prospector

p.s. I mentioned Jason Cimpl’s paid product Trademaster Daily Stock

Alerts – (which is worth every penny) but if you just want to test-drive

Jason’s research, he recently launched a new free daily letter which comes

out every weekday after the market close. He calls this service Trademaster

Market Forecast, and you can sign up by clicking here

now.

Facebook

Facebook

Twitter

Twitter