Monday Could Be the Best Time to Invest in the Past Decade

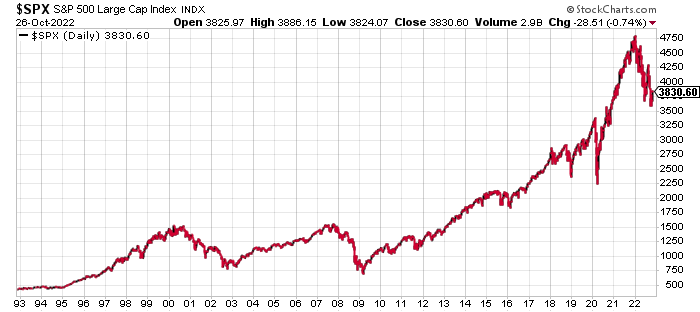

2022 has been one of the less enjoyable years for investors. The past couple of months have been even less enjoyable.

Trading in September produced one of the steepest monthly declines in recent memory.

Market volatility in October can be likened to one of those cheap whipsawing amusement rides you’ll find at a county fair.

Stocks across the board are down year to date by double-digits.

With the probability of a recession rising, are more double-digit stock-market declines in store?

We can’t know for sure, of course, but if I were to bet, I would bet “no.”

Come to think of it, I have bet “no.”

I have steadily added to my holdings over the past two months. I have sold nothing, with one exception – put options on stocks I’d like to own at the right price.

Why am I betting “no”?

Bear markets and recessions frequently walk shoulder to shoulder. You get one, you get the other.

Recessions, though, have led in recent history. The economy has turned sour before the bear market arrived since the 2000s.

This means that when stocks begin to rally, the economy could already be recovering.

I prefer not to miss the start of the rally and the recovery. I’ll give you my reasons for my preference.

Half of the S&P 500 Index’s best days over the past 20 years occurred during a bear market. Another 34% of the index’s best days occurred during the first two months of a bull market – while it was still unclear a bull market had begun.

If I mistime my return and I’m late to the party, I’ll pay dearly.

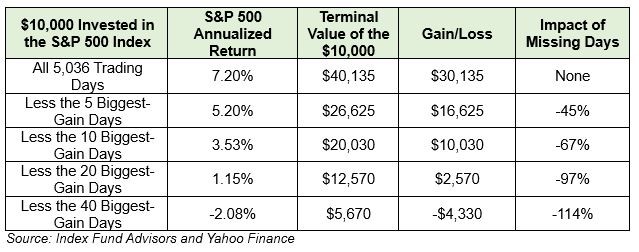

The data show that wealth-changing gains are frequently concentrated in just a few days.

The table below covers the S&P 500 from Jan. 1, 1998 through Dec. 31, 2017. Missing only five good days was a big deal. Missing 20 or more good days was a disaster.

You could counter that timely selling would mean missing the worst-performing days.

You wouldn’t be wrong.

Missing the 40 worst-performing days of the S&P 500 Index over the past 20 years would help. Your returns would have been 952% higher than returns of investors who stayed put.

But let’s factor in reality. Good luck identifying the worst 40 days. The odds of doing so only slightly lag those of picking the numbers for a winning power-ball ticket.

Keep in mind that the market bias is up.

The average bear market lasts roughly 10 months. The average decline is 36%.

The average bull market lasts 32 months. The advance has averaged 114% from the previous trough.

My bias is to remain invested so that I can exploit the stock market’s bias over the long haul.

Good Fortunes,

Stephen Mauzy

Facebook

Facebook

Twitter

Twitter