You may be getting duped by the U.S. government. That is, if you’re like millions of others who own a certain popular government-backed income investment.

So what is this villainous investment I refer to?

Treasury Inflation Protected Securities, better known by the acronym “TIPS.”

TIPS are debt issued by the U.S. Treasury that are linked to the consumer price index (CPI). As the CPI rises, the principal is adjusted higher. The coupon rate remains constant, but it generates a higher interest payout when applied to the inflation-adjusted principal.

Many investors assume that TIPS are both an income investment and an inflation hedge. They therefore assume TIPS maintain purchasing power.

They assume wrong. TIPS provide neither worthwhile income nor inflation protection.

Last month, the Treasury Department sold $13 billion in 10-year TIPS … at a negative yield of 0.75%. In other words, investors (mostly institutions and central banks) paid for the privilege to finance the federal government. September marked the fifth consecutive month they were willing to do so.

Of course, these buyers are expecting to eventually receive a return on their investment. These TIPS buyers are betting that as the CPI rises, they will be compensated with an inflation-trumping payout.

The CPI is a government-sponsored inflation measure. The CPI is open to manipulation, and guess whose direction the manipulation favors? The federal government's, of course.

The Bureau of Labors Statistics – a government organization – states that consumer price inflation is running at 1.7% annually. That's simply wrong, as any consumer can confirm by a visit to any retail outlet. Trust your eyes. They aren't lying. Inflation is running much higher than 1.7%.

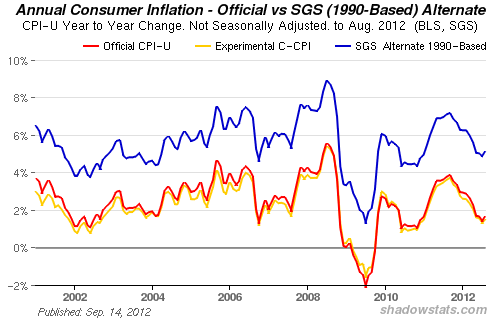

I rely on private, unbiased sources like Shadowstats to confirm inflation reality. And the reality is that consumer price inflation is running at a much higher rate than the government says. In fact, Shadowstats data show consumer price inflation (blue line below) running three percentage points higher than the official CPI.

There is another reason I don't trust the CPI: the government is free to change the CPI's composition. When the recent debt ceiling impasse was threatening the country with “austerity,” both Republicans and Democrats discussed changing the CPI so that it would live up to inflation- linked entitlement promises in name, but in practice would erode the purchasing power of TIPS.

If the prospect of under-reporting CPI isn't sufficiently underhanded, the Federal Reserve can also intervene to buy TIPS. Doing so intentionally over-prices these securities and increases their inability to protect investors from the ravages of inflation.

The point I want to emphasize is that government will always favor government over you and me.

But that doesn't mean income investors have to resign themselves to lost purchasing power through higher inflation and low income.

There's a better way to invest for income and inflation protection. I'm speaking of quality dividend-growth stocks and quality high-yield stocks. Not coincidentally, these are exactly the investments featured in my High Yield Wealth portfolio, which yields 8% on the 21 diverse income investments it holds.

The portfolio includes quality dividend growers like Altria (NYSE: MO) – which has raised its dividend 44 consecutive years and yields over 5% – and McDonald's (NYSE: MCD), which has raised its dividend every year since 1976. These investments not only maintain purchasing power, they maintain and expand real wealth.

In fact, both McDonald's and Altria have returned more than 30% each to the High Yield Wealth portfolio since their respective inclusions. That's purchasing power and wealth growth in spades.

Don't think these investments are riskier because of their lack of government “guarantee.” Unlike TIPS, high-yield and dividend-growth investments aren't subjected to manipulation to favor the issuer. Yes, you'll get your principal back on TIPS at maturity, but you'll suffer severe opportunity costs and purchasing-power loss in the interim.

In short, a diversified portfolio of quality dividend payers and high-yield stocks will provide more purchasing power, more wealth, and more income than any government-issued security.

Facebook

Facebook

Twitter

Twitter