Editor’s note: In today’s Daily Profit, options analyst Andy Crowder continues to answer reader mail in the wake of his last live chat event. If you still have questions for Andy, not to worry: the next options live chat event has been scheduled for Thursday, April 5, at 1:00 p.m. Eastern Time.

Editor’s note: In today’s Daily Profit, options analyst Andy Crowder continues to answer reader mail in the wake of his last live chat event. If you still have questions for Andy, not to worry: the next options live chat event has been scheduled for Thursday, April 5, at 1:00 p.m. Eastern Time.

Tune in then to listen to Andy discuss all things options and to ask Andy all of your pressing options-related questions. Click here to register today!

Now, on with today’s featured options mailbag question:

Andy, I immensely enjoy your articles in The Strike Price and Daily Profit. I’ve been investing for more than 10 years and started using credit spreads last year as the strategy made perfect sense to me.

My question is, how do you select which ETF or stock to use in your strategy and do you offer a list of the underlying ETF or stocks you trade for the Options Advantage service?

Thanks,

Joe V.

Joe, thank you for the great question. It is one that has been asked countless times since my last live chat (view here).

I focus on more liquid and actively traded ETFs and stocks that have tight bid/ask spreads, rather than underlyings with little to no volume and wide bid/ask spreads. As a result, I have created a list of approximately 40 ETFs that are available exclusively to my Options Advantage subscribers on a daily basis. I will be discussing this in great detail in my upcoming live chat.

I like to think of the spread between the bid/ask as another commission, but this one goes to the market maker rather than the brokerage firm.

Typically you buy on the ask and sell on the bid, and this goes for both puts and calls. Of course, you can always enter a limit order and get filled in between the market, but this is not a guarantee.

Think about it this way: If you are trading a put with a bid/ask spread of $1 (yes, there are many out there) and you buy just 10 contracts, you are immediately marked at a $1,000 loss excluding commission.

Now imagine that you purchased a 70-delta put and the stock falls $1, theoretically making $700 on your correct market assumption. You may still be at a loss in your trade because the bid/ask spread of $1 is still too much to overcome. You might need an additional move of roughly $0.60 just to break even.

Granted, spreads are usually wide for a reason: either the stock is thinly traded or it may have a high relative volatility.

Usually trading stocks or ETFs with poor volume isn’t the soundest strategy. And that’s why I have created a list for my Options Advantage subscribers that includes the most liquid ETFs in the options market.

Remember, the lower the spread, the less your immediate loss will be in a trade. This is why I prefer to trade options with spreads less than $0.10.

A real-world example of how volume effects the bid/ask spread should help to clarify.

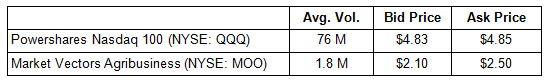

Let’s use Powershares Nasdaq 100 (NYSE: QQQ) and Market Vectors Agribusiness (NYSE: MOO) for our example. I chose these two ETFs because they both have share prices of roughly $50 a share. I want to choose two ETFs with equal properties, other than volume. The impact of volume will be blatantly obvious on the bid/ask spread.

If you look at the September 50 calls for both stocks you will see the following bid/ask spread:

Notice the difference?

The bid/ask spread is $0.02 on QQQ compared to an enormous $0.40 on MOO.

This difference is the reason why a tight bid/ask spread is so critical when using options as part of your investment strategy. You can rarely buy an options contract at anything other than the ask price, and you can rarely sell one at anything other than the bid, especially if the options are illiquid. With a wide bid/ask spread you are technically underwater 10 to 30 percent or more right from the get-go. Nobody wants to be required to earn 10% – 30% just to break even.

Just think: If you bought MOO and paid $2.10 for the option contract, you would have needed to make $0.40, or 19%, just to break even. Of course, you could try to wiggle your way into the price by placing a bid at $2.30 in between the bid/ask price, but you would still have to make $0.20, or just over 8.5%, to break even. This is why it is CRUCIAL to only use options that are liquid and have tight bid/ask spreads.

In conclusion, dealing with the bid/ask spread is an inevitable part of the options arena. Focus on more liquid and actively traded contracts that have smaller bid/ask spreads, rather than stocks with little to no volume and wide spreads.

Once you put this lesson to work using options as part of your investment strategies you will save yourself many headaches and, most importantly, hard-earned money.

Andrew Crowder

Editor and Chief Options Strategist

Options Advantage

Facebook

Facebook

Twitter

Twitter