A roller-coaster ride would be less stomach-churning.

Up 13% in four weeks, down nearly 9% the following two. That was the S&P 500 from mid-July to the present.

When we focus only on August, we find the S&P 500 is down 4.8% for the month.

History tells us that’s not good news.

Dating back to 1928, the S&P 500 has dropped 0.6% on average in September after a down August. And when the index has been down year to date through the end of August (as it is this year), it has averaged a 3.4% drop in September.

The problem only compounds. Should the S&P drop 2.0% or more in September, history points to even deeper declines in October.

It appears history would have us sell. Why suffer additional losses?

Not so fast.

We are dealing with history and averages, after all, which impart knowledge but not conclusions.

Consider last September. The S&P 500 finished the month down 5%. Commentators at the time were telling us to brace for a down market through the remainder of the year.

But it turned out otherwise.

Elon Musk Reveals Secret Master Plan

Tesla’s founder is just days away from revealing his CONFIDENTIAL Master Plan 3.0. You could’ve earned 1,766% – 24,017% profits investing after he released Master Plan Part 1 & 2. Now it’s time for you to BUY these 5 stocks – before Elon reveals everything. Click here for details.

The S&P 500 rallied through the fourth quarter of 2021 to finish the year up 25%.

I suspect that a repeat is unlikely this year. Circumstances have changed considerably. Inflation and interest rates are weights today that were unknown a year ago.

I don’t own the S&P 500. I own a diversified portfolio of diversified stocks, many of which are gleaned from our recommendations. That said, a diversified portfolio of quality stocks will move similarly to the S&P 500. (Of course, we expect more movement to the high side.)

I have not sold one of my stocks this year. On the contrary, I have been a buyer. I have added to stocks I already own. I have opened new positions.

Why?

Because this, too, shall pass. Again, we look to history.

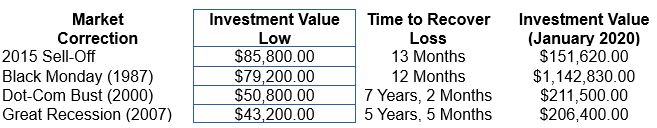

Let’s see what a $100,000 investment in the S&P 500 would have done at the onset of a major market correction.

The dot-com bust of 2000 and the onset of the great recession in 2007 were brutal events, to be sure. I don’t expect a repeat of either.

The 1980 recession is best representative of the backdrop today. Inflation was running high. The Federal Reserve was determined to lower inflation by raising interest rates. Sound familiar?

During the 1980 recession, the $100,0000 S&P 500 investment hit a $71,700 low. It lost over 28% of its value. But the loss was reclaimed in less than two years (1 year, 11 months). From there, it was onward and upward to $2.3 million by 2020.

An old Wall Street saying claims that market corrections are the times during which stocks are transferred to their rightful owners. Panic selling on one side, sagacious buying on the other. Greed trumping fear.

I intend to maintain my rightful ownership claim, and increase it with value-priced stocks. I look to get a little greedy along the way.

Perhaps you do, too.

Good Investing,

Stephen Mauzy

Contributing Editor

Facebook

Facebook

Twitter

Twitter