Stocks are setting up for the good.

Even though it appears all bad.

No one will argue it’s been mostly bad in September.

The three key market barometers – the NASDAQ Composite, Dow Jones Industrial Average, the S&P 500 – will end September with one of their worst outings in recent memory.

The relentless selling over the past four weeks (six, really) has taken a toll on investors’ psyche. A high percentage of them find themselves addled by pessimism.

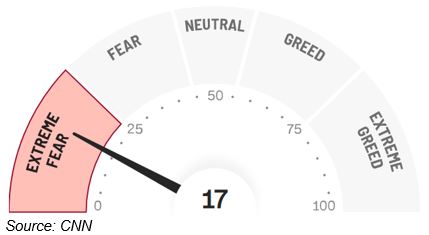

CNN’s revealing Fear & Greed Index offers a glimpse into the extent of the problem.

Additional evidence of soul-crushing pessimism is found in the American Association of Individual Investors (AAII) Sentiment Survey.

The latest AAII Sentiment Survey shows that 60.8% of those surveyed describe their six-month outlook for stocks as bearish. This marks the highest percentage of bearish sentiment since the depths of the market correction in 2009.

I was curious to see who all this pessimism has coalesced to impact the entire stock market.

Discover Elon Musk’s Master Plan 3.0: The billionaire Tesla and SpaceX founder is just days away from releasing his 3rd “Master Plan.” It’ll reveal his detailed plans for launching the 4th Industrial Revolution. Now’s your chance to get urgent details – and buy the right stocks before the news hits. Click here for the urgent briefing.

It has impacted it as you might expect.

I recently ran a screen on 8,000 exchanged-traded stocks to see what percentage traded at a significant discount to their 52-week high.

My screen showed that a third of the 8,000 stocks trade at a 50% or more discount to their respective 52-week highs. More than half trade at a 30% or more discount.

To belabor the obvious, pessimistic investors have done a lot of selling this year.

I Did Say That It Was Setting Up for the Good?

When I’m looking to buy, I get up in a down market.

For one, value goes up when prices go down.

Stock prices are more reasonable today than they’ve been for the past 10 years.

The forward 12-month P/E multiple for the S&P 500 is down to 15.8. The multiple today is below the five-year average (18.6) and the 10-year average (17.0)

AAII’s data show that when that sentiment is extremely bearish (as it is today) the S&P 500 has gone on to post above-average returns over the next six- and 12-month periods.

But what about a recession?

I think we’ll have one, if we’re not experiencing it already.

But that’s not necessarily bad news for stocks.

Stocks usually bottom about six-to-10 months before the economy bottoms.

Surprisingly enough, stocks have rallied 50% of the time during a recession dating back to 1948.

Here’s another reason to consider buying at the lower prices today.

The average one-, three-, five-, and ten-year forward returns for the S&P 500 following a recession are +20.9%, +48.6%, +93.5%, and +256.4%, respectively.

What’s Warren Buffett Doing?

Perhaps he is of a similar mindset as I am.

Berkshire Hathaway’s (NYSE: BRK.b) latest SEC filing shows the company bought another $350 million worth of Occidental Petroleum (NYSE: OXY) shares. I have seen no filing that suggests any selling.

I suppose we can infer that Buffett is more interested in buying than selling. I can understand why, given the values on offer today.

I, too, have been buying. I expect to buy more.

Perhaps you might consider doing the same.

Good Investing,

Stephen Mauzy

Contributing Editor

Facebook

Facebook

Twitter

Twitter