My wife and I are less than a week away from buying a house.

It’s a modest house, situated on seven-plus acres of wooded property in Central Vermont – where we’ve lived for the past four years.

We’ve been renting, saving money for a big down payment and waiting for the right time to buy.

And I think we’ve arrived at the perfect combination of good timing and adequate cash to buy a house.

Interest rates are not quite as low as they were two months ago, but they’re still very close to the all-time lows not just of my lifetime, but likely of everyone’s lifetime.

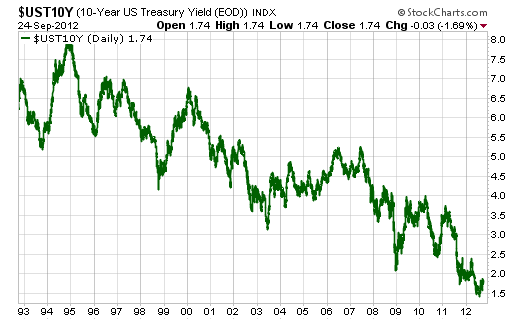

Here’s a 20-year chart showing the yield (interest rate) on 10-Year U.S. Treasury bonds.

It’s not a perfect proxy for mortgage rates, but it tells the same story.

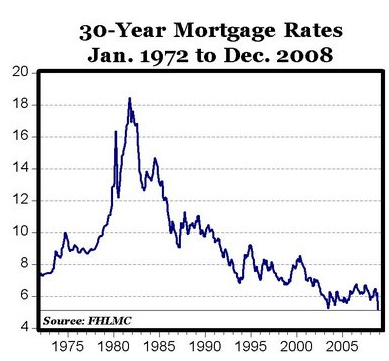

Right now, my wife and I are locked into a 30-year mortgage at a rate lower than anyone got during the entire housing boom and crash.

Until 2008, those rates stayed firmly above 5%. Today they’re less than 4%. Again – today we’re at or near ALL-time lows for mortgage rates. If you don’t buy something when it’s at an all-time low, when will you buy?

So what does our housing purchase have to do with investing in general? Well, right now the Federal Reserve, the U.S. Treasury and a variety of other central banker types around the world have engineered their currencies to make them appear to be very, very cheap.

Money has a cost. That cost is the prevailing interest rate you can get for borrowing and/or lending it out.

Today, we get next to nothing when we lend. That’s why savings account yields are below 1%. It’s why Certificates of Deposit aren’t worth buying. It’s why even 10-Year U.S. Treasuries yield less than 2%.

The flip side of this coin is that we can borrow cheaply as well. The downside to borrowing is the concern that rates will go lower still – meaning that you should have waited longer before borrowing. However, when you borrow low, and rates go higher, you can essentially (and practically) fund your debts with the interest from future savings.

If we return to a period of 6-10% annual interest on something as safe as a 10-Year Treasury bond, it’s a simple matter of letting your interest income pay your mortgage interest. The only constraint is your cash on hand.

Or even better, you can see your debts inflated away by easy-money policy. If lending money is a near-guaranteed money losing bet at these rates, then the flip side is that borrowing money is a near-guaranteed winning bet.

I should say — though we think this house purchase will work out great for us – we’re NOT dipping into emergency cash to make it happen.

And we’re certainly not dipping into our emergency gold and silver supplies either. We’re not even selling any stock.

But we did sell all of the bonds we own.

All of these situations will reverse some day. Some day, we’ll load back up on bonds. We’ll sell all or most of our precious metals. We’ll sell our house and our stocks too.

But that day is far off. For now, we’re still adding to our precious metals positions, holding our stocks and enjoying a nice, low-interest home loan that Ben Bernanke promises to inflate away over the coming decade.

Facebook

Facebook

Twitter

Twitter