Portfolio managers, investors and retirees all have one thing in common: they need yield. Record low interest rates have made it difficult to collect stable yield. Moreover, the Fed appears determined to keep interest rates low for the foreseeable future.

To compensate for low interest rates, investors have flocked to cheap dividend stocks. The SPDR S&P Dividend Index (NYSE: SDY) is up nearly 10% this year, and it’s up 25% since 2012 began.

Though dividend stocks are great investments, they don’t often return double digits – much less 25% – in such time spans. Investors hold these stocks for modest appreciation and responsible yield. However, stock performance from within this sector has outpaced nearly every other group during the past 12 months.

I continue to like dividend stocks, and don’t recommend selling them. At the same time, these stocks are likely overvalued. However, there is one industry where you can find cheap dividend stocks with high yield. In fact, this industry has the chance to rise 30% this year.

Cheap Dividend Stocks You Should Know About

The Market Vectors Gold Miners (NYSE: GDX) ETF is down 30% since 2012 began and 45% from its 2011 high mark. In fact, gold miners were one of the worst performing industries of the past two years.

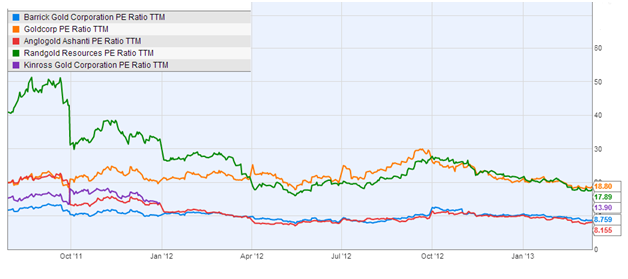

Despite the period of woes, now is a great time to be adding to your gold miner positions because these cheap dividend stocks are more affordable than ever before. The chart below shows that on a price-to-earnings basis, most of the biggest gold miners are the cheapest they’ve been in months and – in a few cases – years.

More importantly, earnings haven’t been the driving factor behind record-low P/E ratios. The low P/E ratios for miners are mostly, if not entirely, related to the fall in share prices. Though the P/E ratios declined 25% since last year, most of the stocks lost 30% to 50% of value. This is a positive sign for investors because it shows that earnings stability kept the P/E ratio from declining at a faster rate than share price. And it indicates that these miners could be undervalued and oversold.

As see in the price performance chart above, Randgold (brown) is the only stock from the bunch to sport a gain since March 2011. Meanwhile, Barrick Gold (blue), Goldcorp (red), AngloGold (forest green) and Kinross Gold (lime green) recorded greater-than-30% declines. In fact, AU and KGC have fallen nearly 50%. So it’s no wonder that the P/E ratios for this ragtag bunch of miners have been halved during the same period, too.

Meanwhile, the Fed expanded their balance sheet at an alarming rate. The Fed’s balance sheet, which is a broad gauge of its lending to the system, hovered just above $900 billion in September 2008. It reached $3.1 trillion this February. The holdings of Treasuries totaled $1.7 trillion while the ownership of mortgage bonds increased to $1.01 trillion.

Generally, the Fed will add to its balance sheet (increase assets) to increase the money supply in the system. Inflation expectations often increase when the money supply increases. Though we haven’t had runaway inflation, it’s a risk so long as the Fed adds to its balance sheet. And even if inflation doesn’t occur, the value of the dollar has already declined, and will likely continue to do so in future years.

So the Fed is playing a dangerous game by trying to manipulate the economy through tinkering with money supply. This should increase the value of hard assets including silver and gold. And gold and silver miners benefit as silver and gold prices increase.

True enough, the industry has done a miserable job of taking advantage of rising metal prices during the past few years. In fact, costs to mine gold have increased 50% (on average according to Bloomberg) in two years while the price of gold increased by only 35% in that window.

Most miners have done a poor job of managing costs, resulting in sluggish or no earnings growth and causing stock prices to decline. However, the Fed’s actions make this a great industry for long-term investors because gold prices should increase. Once mining costs come down, we’ll see EPS expand. Gold mining stocks are also incredibly cheap at current valuations, meaning that now is the time to buy.

Moreover, some of these miners pay out solid dividends. Barrick Gold (NYSE: ABX), Goldcorp (NYSE: GG), AngloGold (NYSE: AU), Royal Gold (NASDAQ: RGLD) and Kinross (NYSE: KGC) yield 2.7%, 1.8%, 0.9%, 1.2% and 2%, respectively. Dividend stocks are unlikely to go out of favor any time soon, but many could be near the high-water mark. Gold miners have fallen in recent years, but that decline won’t last forever and investors can collect decent yield from these cheap dividend stocks in the interim.

Facebook

Facebook

Twitter

Twitter